New Kamoa-Kakula preliminary economic assessment

of two mines, with projected, combined production

of 12 million tonnes per year, nearing completion

New Kakula resource estimate based on the entire current

strike length expected early in January 2018; discovery remains

open for significant expansion

14 drill rigs continue to operate at Kamoa-Kakula

KOLWEZI, DEMOCRATIC REPUBLIC OF CONGO – Ivanhoe Mines (TSX: IVN; OTCQX: IVPAF) Executive Chairman Robert Friedland and Chief Executive Officer Lars-Eric Johansson today announced that the Kamoa-Kakula mine development team has celebrated the first blast marking the start of work on the twin declines at the ultra-high-grade Kakula Copper Discovery on the company’s Tier One Kamoa-Kakula Copper Project, near the mining centre of Kolwezi in the Democratic Republic of Congo (DRC).

The Kakula box cut was successfully completed on October 26, 2017, and the first blast for the twin declines at Kakula took place on November 16, 10 days ahead of schedule. The Kakula decline development work is being undertaken by JMMC, a DRC subsidiary of JCHX Mining Management of Beijing, China. Depending on ground conditions, the 3,600-metre decline development contract is scheduled for completion in approximately one year.

In response to the spectacular exploration success at the Kakula Discovery, Ivanhoe Mines and Zijin Mining are fast-tracking the mine development program at Kakula. The Kakula Copper Deposit is a gently-dipping blanket of thick, chalcocite-rich copper mineralization. Initial mine development is planned to begin in the flat, near-surface zone which, at a 3% cut-off, is between 7.1 metres and 11.7 metres thick and with copper grades between 8.11% and 10.35% along the deposit’s axis.

Fourteen rigs are continuing to drill at Kamoa-Kakula, including 10 rigs focused on expanding and upgrading the resources in the Kakula high-grade zone along trend to the west and southeast. A fresh resource estimate for Kakula is being prepared and is expected to result in a major upgrade and expansion of the Kakula Mineral Resources.

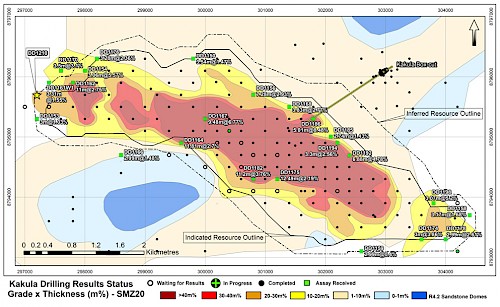

The area encompassed by the May 2017 Kakula Mineral Resource and the location of the Kakula box cut and declines are shown in Figure 1.

Preparing for the first blast for the twin declines at the Kakula box cut

– November 15, 2017.

Abraham Li (left), Deputy General Manager of Kamoa Copper,

and Mark Farren (right), Ivanhoe’s Executive Vice President, Operations,

celebrate the successful first blast on November 16, 2017.

Drilling support holes for the Kakula service decline – November 17, 2017.

Drilling support holes for Kakula service decline following the first blast.

Figure 1. Location plan showing grade and thickness at Kakula resource area superimposed on 2% composite grade thickness contours. The Kakula box cut and direction of the twin declines are shown in upper right corner.

New expanded-case Kamoa-Kakula preliminary economic assessment (PEA) scheduled for completion this quarter

The new Kamoa-Kakula Project PEA is progressing well and is expected to be completed this quarter. The PEA is based on an initial mine capacity of six million tonnes per annum (Mtpa) at Kakula, using the May 2017 Mineral Resource estimate, with an additional six-Mtpa mine at Kansoko, serving a centralized concentrator at Kakula, for a projected mine production of approximately 12 Mtpa from the presently delineated Kamoa and Kakula deposits.

In addition to the new PEA study, preliminary work is underway on a six-Mtpa pre-feasibility study at Kakula that will be based on the upcoming, January 2018 resource model. The study will be considered as the base case for the first phase of development at Kamoa-Kakula. In light of the successful step-out drilling at Kakula West, the Kamoa-Kakula development plans will be reassessed and amended as the project moves forward.

Potential phased mine developments of up to 18 Mtpa also are being assessed for the Kamoa-Kakula copper complex.

Exploration geologists examining Kakula drill core at the Kamoa camp facility.

The new drill results are expected to result in a major upgrade and expansion of the Kakula Mineral Resource

Results from drill holes completed to the end of October 2017 will form the basis of the planned updated mineral resource estimate encompassing the entire strike length of the Kakula Discovery, which now extends to at least 12 kilometres. This would represent an increase of approximately 60% in the strike length that will be used to calculate the new resource estimate, as compared to the 7.7-kilometre strike length covered by Kakula’s May 2017 resource estimate. The updated resource estimate is expected to be issued in January 2018.

“We’re looking forward to providing our shareholders and all Kamoa-Kakula stakeholders with another substantial resource expansion soon after the coming holiday season,” said Mr. Friedland.

About the Kamoa-Kakula Project

The Kamoa-Kakula Project is a very large, stratiform copper deposit with adjacent prospective exploration areas within the Central African Copperbelt, located approximately 25 kilometres west of the town of Kolwezi and about 270 kilometres west of Lubumbashi. The Kamoa Copper Deposit was discovered by Ivanhoe Mines (then named Ivanhoe Nickel & Platinum) in 2008, followed by the discovery of the Kakula Deposit in early 2016.

Based on a May 2017 Mineral Resource estimate prepared under the direction of Dr. Harry Parker and Gordon Seibel of Amec Foster Wheeler, the combined Kamoa-Kakula Indicated Mineral Resources total approximately one billion tonnes grading 3.02% copper, containing 66 billion pounds of copper, plus another 191 million tonnes of Inferred Resources at 2.37% copper,at a 1.4% copper cut-off grade.

In August 2012, the DRC government granted mining licences to Ivanhoe Mines for the Kamoa-Kakula Project that cover a total of 397 square kilometres. The licences are valid for 30 years and can be renewed at 15-year intervals. Mine development work at the project began in July 2014 with construction of a box cut for the decline ramps for the planned Kansoko Sud Mine.

Ivanhoe Mines and Zijin Mining each hold an indirect 39.6% interest in the Kamoa-Kakula Project, Crystal River Global Limited holds an indirect 0.8% interest and the DRC government holds a direct 20% interest.

Qualified Person and Quality Control and Assurance

The scientific and technical information in this release has been reviewed and approved by Stephen Torr, P.Geo., Ivanhoe Mines’ Vice President, Project Geology and Evaluation, and a Qualified Person under the terms of National Instrument 43-101. Mr. Torr, who is not independent of Ivanhoe Mines, has verified the technical data disclosed in this news release.

Ivanhoe Mines maintains a comprehensive chain of custody and QA-QC program on assays from its Kamoa-Kakula Project. Half-sawn core is processed at Kamoa-Kakula’s on-site preparation laboratory and prepared samples then are shipped by secure courier to Bureau Veritas Minerals (BVM) Laboratories in Australia, an ISO17025-accredited facility. Copper assays are determined at BVM by mixed-acid digestion with ICP finish. Industry-standard certified reference materials and blanks are inserted into the sample stream prior to dispatch to BVM. For detailed information about assay methods and data verification measures used to support the scientific and technical information, please refer to the Kakula 2017 Resource Update, June 2017 technical report available on the SEDAR profile of Ivanhoe Mines at www.sedar.com or under technical reports on the Ivanhoe Mines website at www.ivanhoemines.com.

About Ivanhoe Mines

Ivanhoe Mines is advancing its three principal projects in Southern Africa: 1) Mine development at the Platreef platinum-palladium-gold-nickel-copper discovery on the Northern Limb of South Africa’s Bushveld Complex; 2) mine development and exploration at the Tier One Kamoa-Kakula copper discovery on the Central African Copperbelt in the Democratic Republic of Congo; and 3) upgrading at the historic, high-grade Kipushi zinc-copper-silver-germanium mine, also on the DRC’s Copperbelt. For details, visit www.ivanhoemines.com.

Information contacts

Investors

Bill Trenaman +1.604.331.9834

Media

North America: Bob Williamson +1.604.512.4856

South Africa: Jeremy Michaels +27.82.772.1122

Cautionary statement on forward-looking information

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws, including without limitation: (1) statements regarding the scheduled completion of the 3,600-metre decline development contract in approximately one year, depending on ground conditions; (2) statements regarding initial mine development is planned to begin in the flat, near-surface zone which, at a 3% cut-off, is between 7.1 metres and 11.7 metres thick and with copper grades between 8.11% and 10.35% along the deposit’s axis; (3) statements regarding the expectation that a new expanded-case Kamoa-Kakula preliminary economic assessment is scheduled for completion this quarter; and (4) statements regarding the expectation to issue an updated Kamoa-Kakula resource estimate in January 2018 and the expectation that the new estimate will result in a major upgrade and expansion of the Kakula Mineral Resources.

All such forward-looking information and statements are based on certain assumptions and analyses made by Ivanhoe Mines’ management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believe are appropriate in the circumstances. These statements, however, are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information or statements including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts to perform as agreed; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, or delays in the development of infrastructure, and the failure of exploration programs or other studies to deliver anticipated results or results that would justify and support continued studies, development or operations. Other important factors that could cause actual results to differ from these forward-looking statements also include those described under the heading “Risk Factors” in the company’s most recently filed MD&A as well as in the most recent Annual Information Form filed by Ivanhoe Mines. Readers are cautioned not to place undue reliance on forward-looking information or statements. The factors and assumptions used to develop the forward-looking information and statements, and the risks that could cause the actual results to differ materially are set forth in the “Risk Factors” section and elsewhere in the company’s most recent Management’s Discussion and Analysis report and Annual Information Form, available at www.sedar.com.

This news release also contains references to estimates of Mineral Resources. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on, among other things: (1) fluctuations in copper or other mineral prices; (2) results of drilling; (3) results of metallurgical testing and other studies; (4) changes to proposed mining operations, including dilution; (5) the evaluation of mine plans subsequent to the date of any estimates; and (6) the possible failure to receive required permits, approvals and licences.

Although the forward-looking statements contained in this news release are based upon what management of the company believes are reasonable assumptions, the company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this news release.

English

English Français

Français 日本語

日本語 中文

中文